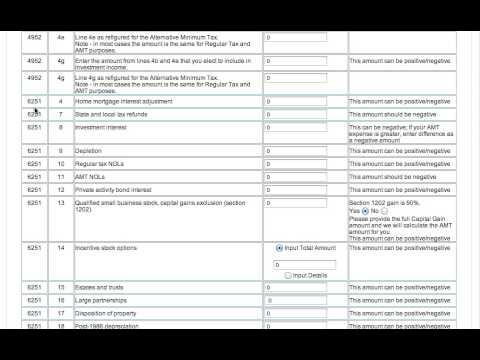

Hey, we're going to show you how to calculate taxes. We've logged into our go tax calculator account and from the main menu, we're going to select 2013 to start. This will take us to the data input screen. The IRS Form number, line number, and description have been provided. In the amount column, we will input our amounts. Our first step in calculating taxes is to select our filing status. In this case, there are five statuses, and we have chosen "married filing jointly". Next, we will input the number of exemptions claimed, which would be one for each dependent. As we scroll down, we will reach our adjusted gross income section. This includes wages, salaries, bonuses, and tips, which are common to everyone. We also have interest income from banking institutions or certificates of deposit, as well as dividends, which can be found on Schedule B. If you are a sole proprietor, you would include business income or loss, and capital gains or loss from Schedule D. For the rest of the items, you can see which ones are applicable to your situation. This may include IRA distributions, pensions, and Social Security benefits for retirees or senior workers. After entering the income section, we will scroll down to deductions. Here, you have the option to select either the standard deduction or itemized deductions. In our example, we assume that this household owns their own property and lives in a state with state and local taxes. Therefore, we have included amounts for state and local real estate taxes, interest paid on the mortgage, and charitable contributions. Once deductions are completed, we will move on to the capital gain section and input our net capital gain, whether it be short or long-term, or any capital gains distributions. To ensure accuracy, we will also review the...

Award-winning PDF software

Schedule Se calculator Form: What You Should Know

IRS regulations. You will only receive a single copy at the address listed here.

online solutions help you to manage your record administration along with raiSe the efficiency of the workflows. Stick to the fast guide to do Form instructions 1040 (Schedule Se), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 1040 (Schedule Se) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- USe your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 1040 (Schedule Se) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 1040 (Schedule Se) from the internet connected gadget, personalize it baSed on your requirements, indicator this in electronic format and also disperSe differently.

Video instructions and help with filling out and completing Schedule Se calculator